Council leaders are preparing for a particularly challenging budget for 2023/24 as unprecedented uncertainty linked to national and global issues takes its toll.

They estimate that local authority finances will be hit to the tune of £29 million with inflation accounting for two-thirds.

This is in sharp contrast to previous years when the council replenished its reserves and announced ambitious plan to help those most affected by the cost of living crisis and tackle the climate emergency.

Councillor Eamonn O’Brien, leader of the council, said: “We know that most people are paying more and getting less as every year our resources are increasingly stretched beyond our control.

“More than £100m of government grants have been withdrawn in the last 10 years, and there is increasing demand for services – particularly in adults’ and children’s social care, which together make up two-thirds of our budget.

“We know that people and businesses need support, and we’ve made it our strategy to protect them as much as possible. In previous years we’ve managed by being prudent and broadly managing cuts. But inflation is hitting the council more than before and three quarters of the savings we need to find are due to rising costs.

“The latest budget forecasts are that we will need to make cuts of £29m in 2023/24. This has rapidly increased from £14m due to the unprecedented uncertainty with the economy. Like everyone else we’re being hit by volatile energy prices and the cost of living crisis.

Cllr Richard Gold, Cabinet Member for Finance and Communities, added: “We are awaiting the announcement of how much the government will be providing in grants, the financial settlement, which usually takes place in December. This is an opportunity to either improve the situation and recognise that inflation is hitting our financial position, or it could make our forecast the grim reality it is currently looking like.

“We are listening to residents’ and we remain ambitious for the future of our borough but there are lots of risk. If it wasn’t for inflation we wouldn’t be proposing this difficult budget.”

Consultation took place during the summer about our spending priorities and the proposals present a number of options for savings within services based on the results, as well as using reserves.

The largest saving target is in children’s services with £4.9 million earmarked for reviews of high-cost social care placements and the provision of more specialist housing and foster carers in the borough to save costs.

£5.7 million is set to be saved through strategic financial management which means more accurately accounting for internal processes and how staff are deployed between revenue services and capital projects in order to balance the books.

A further £6.5 million could be saved by increasing income generation including council tax, business rates and an uplift in fees and charges.

There are also savings of £1.1 million earmarked in adult services to remodel sheltered housing where support is currently duplicated and cease home visits where it is solely to remind customers to take medication.

In addition, a further £1 million could be raised through an options appraisal of Bury Art Museum and workforce cost savings.

If the proposals are approved at Cabinet on 19 October consultation will begin through an online survey at www.onecommunitybury.co.uk and will run until 15 December, with results reported back as part of the final budget approval process in February 2023.

Rochdale businesses recognised at annual awards ceremony

Rochdale businesses recognised at annual awards ceremony

Tetrosyl strike deepens as union accuses employer of illegal tactics and Christmas ‘cruelty’

Tetrosyl strike deepens as union accuses employer of illegal tactics and Christmas ‘cruelty’

Peine Square transformed in £1m Heywood regeneration project

Peine Square transformed in £1m Heywood regeneration project

Music and creativity team win national award for bringing joy to supported lives

Music and creativity team win national award for bringing joy to supported lives

United Utilities begins £4.5 million project to protect Castleton waterways

United Utilities begins £4.5 million project to protect Castleton waterways

Rochdale to be transformed by immersive nighttime storytelling experience

Rochdale to be transformed by immersive nighttime storytelling experience

UK economy faces tipping point as small firms warn of rising insolvency risk

UK economy faces tipping point as small firms warn of rising insolvency risk

Prison watchdog flags safety concerns and strained resources at HMP Buckley Hall

Prison watchdog flags safety concerns and strained resources at HMP Buckley Hall

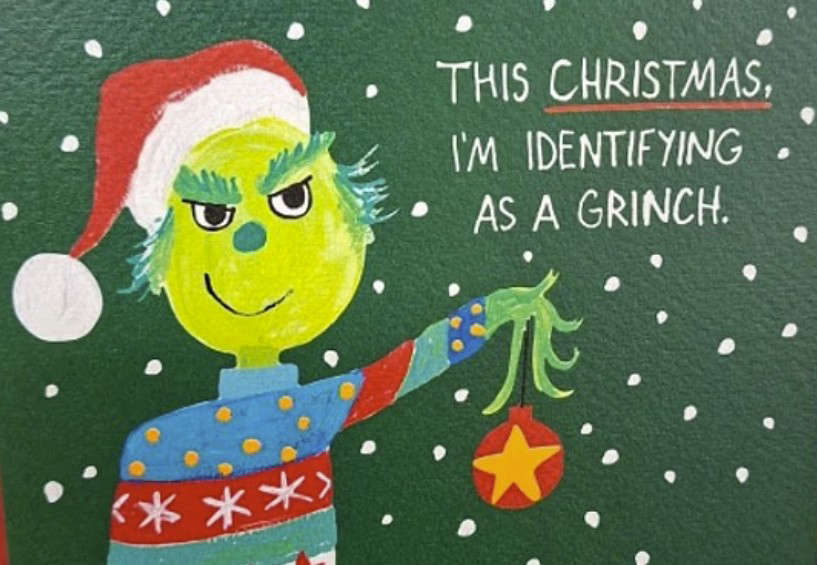

Grinch Christmas card withdrawn from Sainsbury’s following transphobia complaints

Grinch Christmas card withdrawn from Sainsbury’s following transphobia complaints

The relief road that could save a town from traffic nightmare

The relief road that could save a town from traffic nightmare

Child Protection Investigation Unit praised for relentless work safeguarding children in Rochdale

Child Protection Investigation Unit praised for relentless work safeguarding children in Rochdale

Before the red suit this the surprising history of Father Christmas

Before the red suit this the surprising history of Father Christmas

Comments

Add a comment